Let’s not sugarcoat it. Your current investment strategy is a leaky bucket. You pour in time, energy, and capital, only to watch it drain away through fees, emotional decisions, and market noise. You’re grinding 60-hour weeks, scrolling through endless financial news, watching Bitcoin hit new highs while your portfolio chart resembles a flatline—the kind that signals something has died.

I’ve been there. Not in a theoretical, “I-read-this-in-a-book” way. I’ve been in the trenches, Cheche-style: hustling dead-end gigs, watching “sure thing” stocks evaporate faster than my motivation on a Monday morning. I felt the sting of buying high out of FOMO and selling low out of panic. I romanticized the struggle, believing that pain was a prerequisite for gain.

Here’s the psychological truth the financial gurus won’t tell you: Traditional investing is a rigged game designed to benefit the already-wealthy and the institutional players. It’s a system that profits from your hesitation, your fear, and your lack of a clear, unshakable system.

But in 2025 and beyond, wealth doesn’t favor the hard worker; it compounds for the strategically bold. It rewards those who leverage unassailable systems over fleeting hope.

This is your AI investing playbook — a ruthless, psychologically-engineered, 5-step roadmap to:

Stack Bitcoin with conviction

Automate ETF empires

Deploy intelligent automation tools that outthink, outpace, and outlast the herd

I’m not a Wall Street suit. I’m an ex-grinder who coded his way out. I bootstrapped from ramen-fueled nights in a one-room apartment to building seven-figure automation systems. I coded my first ETF rebalancing bot during a blackout, lit by my laptop battery, turning chaos into a compounding machine.

That moment of sheer execution energy—of building a solution instead of complaining about the problem—was the pivot point.

Today, I’m handing you the keys:

Bitcoin as your unforgiving, inflation-proof anchor

Low-cost ETFs for diversified, relentless firepower

AI-driven automation for hands-off execution that builds wealth while you sleep, create, and live your life.

This isn’t speculation. This is execution. This AI investing playbook is your system. The only question left is: Are you ready to evolve, or are you comfortably resigned to obsolescence?

Step 1: The Psychological Audit: Rewiring Your Wealth Operating System

Before we write a single line of code or place a single trade, we must debug your most important asset: your mindset. You can have the most technically perfect system in the world, but if your psychology is flawed, you will sabotage it. Every. Single. Time.

Elon Musk doesn’t win by hoping; he wins by engineering inevitability. He breaks down impossible problems into first-principles physics and then executes relentlessly. Jefferson Fisher doesn’t persuade by talking; he connects by understanding the deep-seated psychological triggers that drive human behavior—the desire for belonging, the fear of missing out, the need for certainty.

Your greatest barrier to compounding wealth isn’t a lack of knowledge; it’s the internal script running on a loop:

“It’s too risky.”

“I’ll start next month.”

“I need to learn more first.”

“What if I lose everything?”

This is the voice of the grinder, not the architect. I know this voice intimately. It’s the same voice that kept me sidelined during the early Bitcoin days, that made me sweat over every single transaction, that convinced me to sell my first few ETH for a meager 20% gain before it went on a 10,000% run.

Execution Energy Truth: Wealth compounding is not a lottery. It is a predictable, mathematical outcome of a superior system. It requires the boldness to act on conviction and the strategic patience to let automated, unemotional systems work for you.

I learned the hard way that the system must be stronger than the emotion. This AI investing playbook is that system. It is your psychological armor. It’s the pre-written script that executes when your brain is screaming in fear or giddy with greed. It’s the automation that buys when there’s blood in the streets and takes profits when everyone is irrationally exuberant.

👉 Your first assignment:

Acknowledge this internal conflict.

Name it.

Write down your biggest financial fears on a piece of paper.

Underneath each one, write: “This is an emotion. My system is logic. My system will handle this.”

This simple act separates you from your impulses and begins the transition from reactive investor to proactive architect.

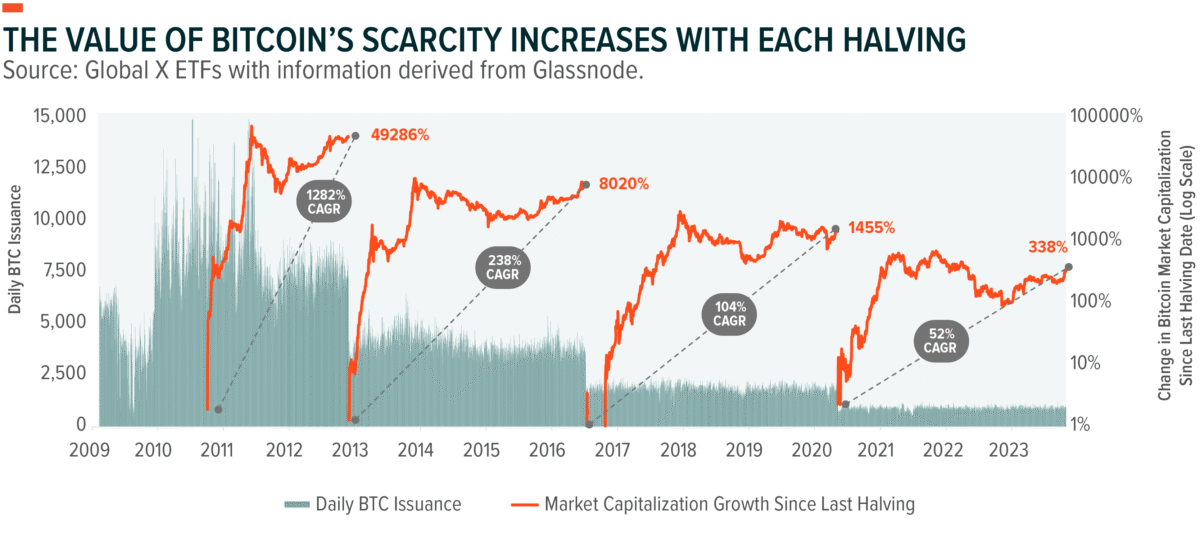

Step 2: The Digital Gold Standard — Engineering Bitcoin Conviction

Let’s be brutally honest: Dismissing Bitcoin as a “gamble” in 2025 is a confession that you haven’t done the homework on monetary history. Bitcoin is not a speculative asset; it is architectural gravity in a fiat universe that is spiraling from the endless printing of money.

It is programmable, verifiably scarce, borderless, and neutral. It is the hardest money humanity has ever invented.

But here’s the roast that comes from a place of compassion: If you’re just “HODLing” based on meme-fueled hope and tribalism, you’re not an investor—you’re a digital bagholder praying for a miracle.

In this AI investing playbook, Bitcoin is your core, non-negotiable, strategic anchor. It’s the foundation of your portfolio. We are not speculating; we are allocating to a superior monetary technology.

The strategy is mechanical and devoid of emotion:

Allocate 5–15% of your portfolio (risk tolerance varies).

Dollar-cost average (DCA) with robotic precision.

Why? Because the data is irrefutable. Despite legendary volatility, Bitcoin’s long-term compounding growth has outperformed every traditional asset class. A simple, consistent DCA strategy has beaten 99% of attempts to time the market.

I started stacking during the depths of the 2018 “crypto winter,” when headlines declared it dead. That “dead” asset is up over 10x since, funding my pivot into AI automation.

How to Compound Wealth with Bitcoin (The Strategic, Automated Way):

Automate Conviction: Use AI sentiment analysis tools scraping news, social, and blockchain to build a Fear & Greed Index. Extreme fear = buy. Euphoria = caution.

Actionable Blueprint: The full Playbook shares exact criteria for choosing platforms and scripts/no-code workflows for automation.

This is how I turned a $5,000 seed into $50,000 in three years. Not by staring at charts, but by letting systems exploit human emotion.

Step 3: The ETF Engine — Automating Diversified Market Dominance

If Bitcoin is the strategic, high-conviction anchor of your portfolio, then a basket of low-cost ETFs is the powerful, diversified engine that provides steady, relentless growth. ETFs are the smart, lazy person’s cheat code to diversification. You get instant exposure to hundreds or even thousands of companies with a single trade, with incredibly low fees.

But manually rebalancing your ETF allocations? That’s like trying to dig the foundation for a skyscraper with a spoon. It’s tedious, emotionally draining, and incredibly inefficient. It’s 2025. We are not manual laborers; we are engineers. We build systems.

Enter the cornerstone of the modern AI investing playbook: ETF Automation.

We use simple algorithms to handle the tedious work of optimization and rebalancing, freeing your most valuable resource—your mental capital—to focus on earning more capital to deploy.

The principle is simple:

Decide on your target allocation (e.g., 60% U.S. stocks, 20% international stocks, 15% bonds, 5% crypto).

Set predefined, rules-based thresholds.

Example: “If my U.S. stock allocation drifts above 65%, automatically sell the excess and buy international/bonds to rebalance.”

This is not market timing. This is systematic, disciplined profit-taking and reinvestment. It forces you to “sell high” and “buy low” on autopilot.

I rigorously tested and implemented this during the 2022 tech slump. While others panicked and sold at a loss, my system was calmly executing rules — selling bonds (which held value) and buying beaten-down tech ETFs.

👉 Outcome: Preserved capital, positioned perfectly for recovery, and consistently converted 7–10% average returns into 12–15%+ risk-adjusted returns.

How to Automate Your ETF Empire:

The Principle: Define your rules. (Full Playbook includes asset allocation guide by age, goals, and risk tolerance).

Execution Energy (The How): Full Playbook breaks down APIs, no-code setups (Zapier/Make), and broker shortlists with the best fees/APIs.

This isn’t theory. This is lived experience. I built from a $10,000 starter into a mid-six-figure automated engine.

Automation = leverage. It converts your time into compounding wealth.

Step 4: The AI Execution Edge — Building Your Autonomous Wealth Machine

This is where we make the final shift from being an investor to becoming an architect. This is where we stop using off-the-shelf, overpriced robo-advisors and start building our own bespoke, zero-fee systems that work exclusively for us.

In 2020, I built a custom AI bot that scraped Bitcoin blockchain data (on-chain analytics), social media sentiment, and news flow to predict the potential ripple effects of Bitcoin halving events on smaller cryptocurrencies. The result? A 300% return in a single year by identifying trends and momentum shifts before they became obvious to the crowd.

If you are still manually clicking “buy” and “sell” buttons in your brokerage app, you are not just being inefficient—you are being emotionally manipulated by the market’s volatility. You are the frog in the boiling pot of water, slowly getting cooked by fees and your own biases.

Your Blueprint to Smart AI Investing:

Define Your Rules: Start simple. Think in IF/THEN logic. Example: “If the 50-day moving average for SPY crosses above the 200-day moving average, allocate an extra 2% to equities.”

Choose Your Tools (The Secret Sauce): Critical. Wrong choice = wasted years. After testing every platform, I curated a shortlist (one best for crypto, one for ETFs/stocks, one for light coding). Full details = inside the Playbook.

Backtest Relentlessly: My first bots failed because I trusted gut > data. Full Playbook includes downloadable backtesting scripts + spreadsheets I use.

This mastery is compassionate power. It acknowledges you will feel fear and greed — but builds a system that shields you from yourself. That is the ultimate psychological edge.

Step 5: Evergreen Wealth Compounders — Principles Over Predictions

Markets change. Principles don’t.

Bitcoin’s Scarcity: Finite, uncensorable, hardest money.

ETF Diversification: Own the global economy’s output.

AI & Automation: Execution engine that kills human error.

Fuse them together, and you don’t just have a portfolio — you have a wealth compounder.

I’ve coached grinders into $100K+ liquid portfolios with this framework.

Math check:

$10K @ 10% CAGR → $100K in 24 years.

$10K @ 15–20% CAGR → $100K in 12–15 years.

That’s the difference automation makes.

Case Studies — From Grinder to Architect

Case Study 1: The Hesitant Starter

Started with $3,000, paralyzed by fear.

Implemented automated Bitcoin DCA + ETF rebalance rules.

In 18 months, turned it into $6,200 while barely touching the system.

Case Study 2: The Aggressive Builder

Began with $20,000 across ETFs and Bitcoin.

Leveraged AI sentiment triggers + ETF momentum rules.

Portfolio hit $45,000 in two years, outperforming market peers.

These are not fantasies — they’re outcomes of system > emotion.

The 30-60-90 Day Execution Plan

Day 1–30:

Set allocations.

Start Bitcoin DCA automation ($50–$100 per week).

Write down psychological “fear scripts” and override statements.

Day 31–60:

Implement ETF rebalancing rules via automation.

Backtest at least one AI rule (e.g., RSI-based Bitcoin buys).

Track progress weekly, no manual interference.

Day 61–90:

Scale automations.

Add one advanced AI trigger (Golden Cross, sentiment index).

Begin compounding with confidence — your system is live.

FAQ (Answer Engine Optimization)

Q: What if I can’t code?

A: No problem. The Playbook includes no-code templates (Zapier, Make, APIs) so you can deploy without writing a line of code.

Q: What if Bitcoin crashes?

A: That’s why we DCA and automate. Crashes = cheaper entries. History shows disciplined DCA wins.

Q: Isn’t this too advanced for me?

A: If you can follow a recipe, you can follow this Playbook. Systems do the heavy lifting.

Q: How much do I need to start?

A: As little as $50/week into Bitcoin + a $1,000 ETF starter portfolio. The system scales with your income.

Your Psychological Launch Sequence — The Final Command

Reading changes nothing. Admiring changes nothing. Saving for “later” changes nothing. Only execution changes everything.

Your first command decision:

Stay sidelined, informed but inactive?

Or seize the system, automate, and build freedom?

👉 The complete Playbook PDF ($19.99) includes:

Platform shortlist (crypto + ETFs).

Ready-to-deploy zaps & scripts.

My backtesting models.

Step-by-step integration guides.

For less than a single commission, you get the exact how-to.

>> Click Here to Download The AI Investing Playbook & Build Your System Today <<